Printable 1099 form 19 are widely available All 1099 forms are available on the IRS website, and they can be printed out from home This is true for both 19 and 18 1099s, even years laterHowever, it is important to remember that each 1099 filing needs several copies of the form, and not all of them can be printed from home on regular computer paperThey waive any rights as an employee1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayer

1

Printable 1099 form independent contractor

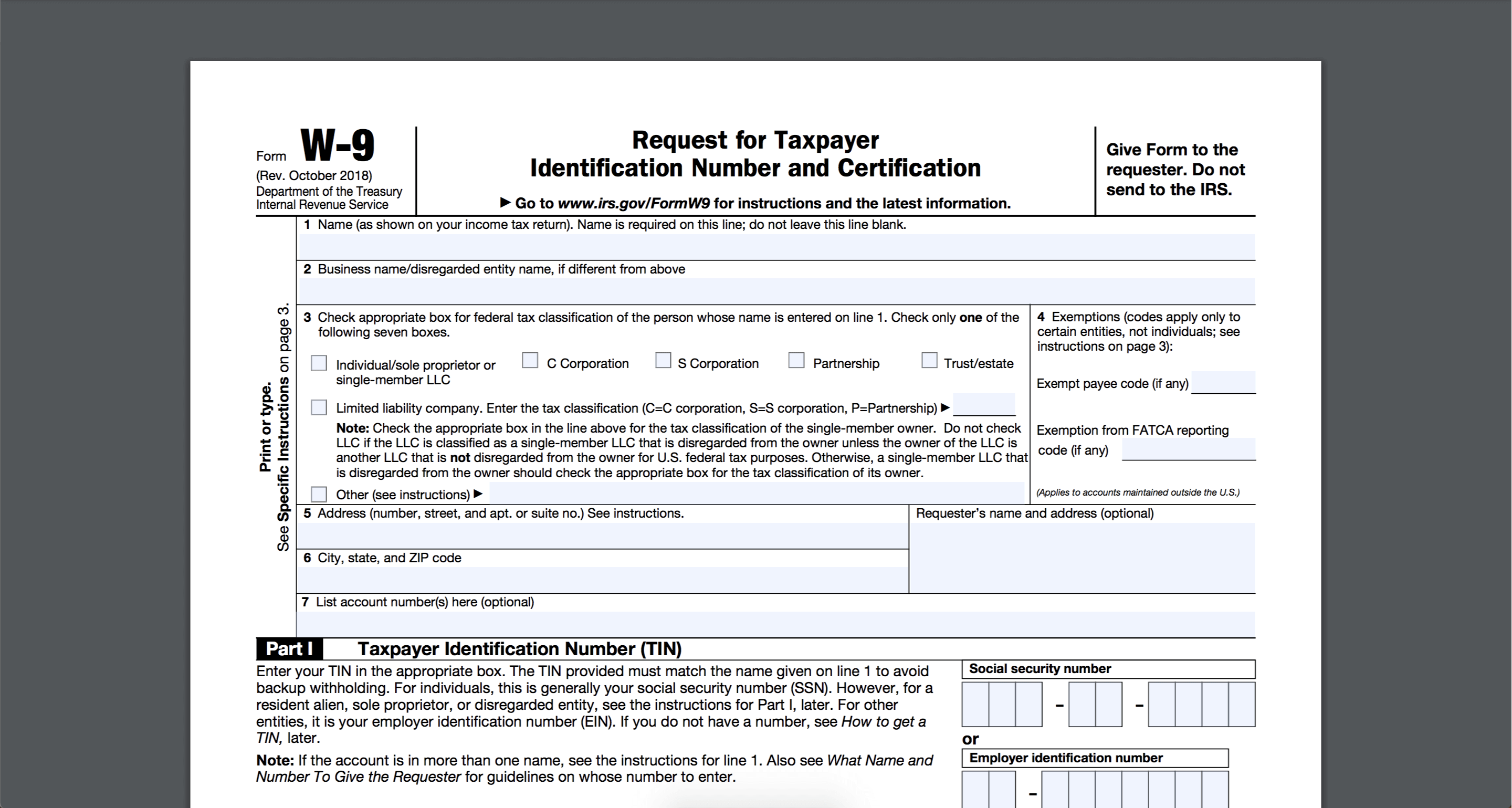

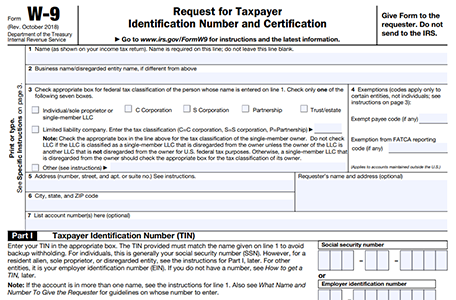

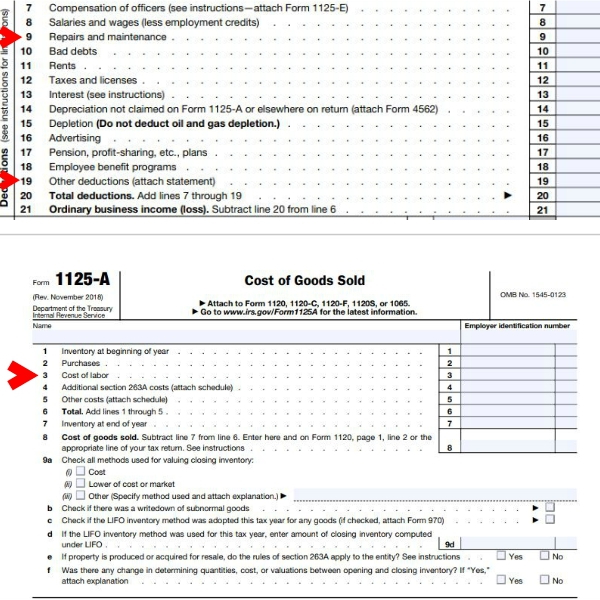

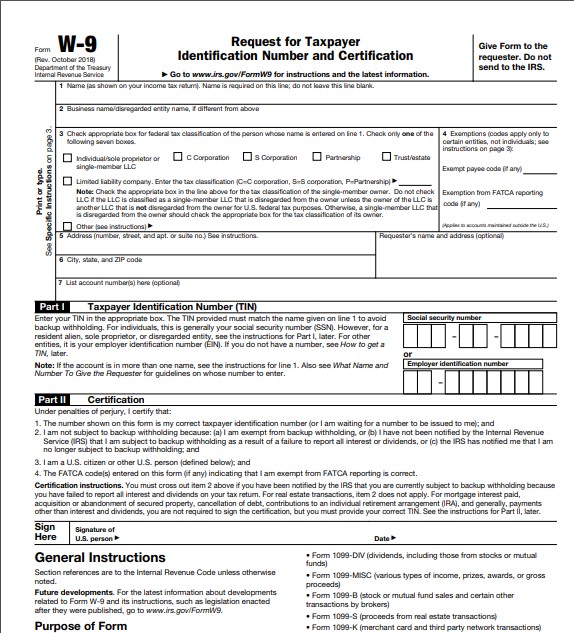

Printable 1099 form independent contractor-Tax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rateYes, the employer who hired/paid an individual apart from regular salary requires a W9 Form to file a 1099 return Generally, when a business pays $600 or more to an independent contractor required to report these payments on a 1099 Form

Create An Independent Contractor Agreement Download Print Pdf Word

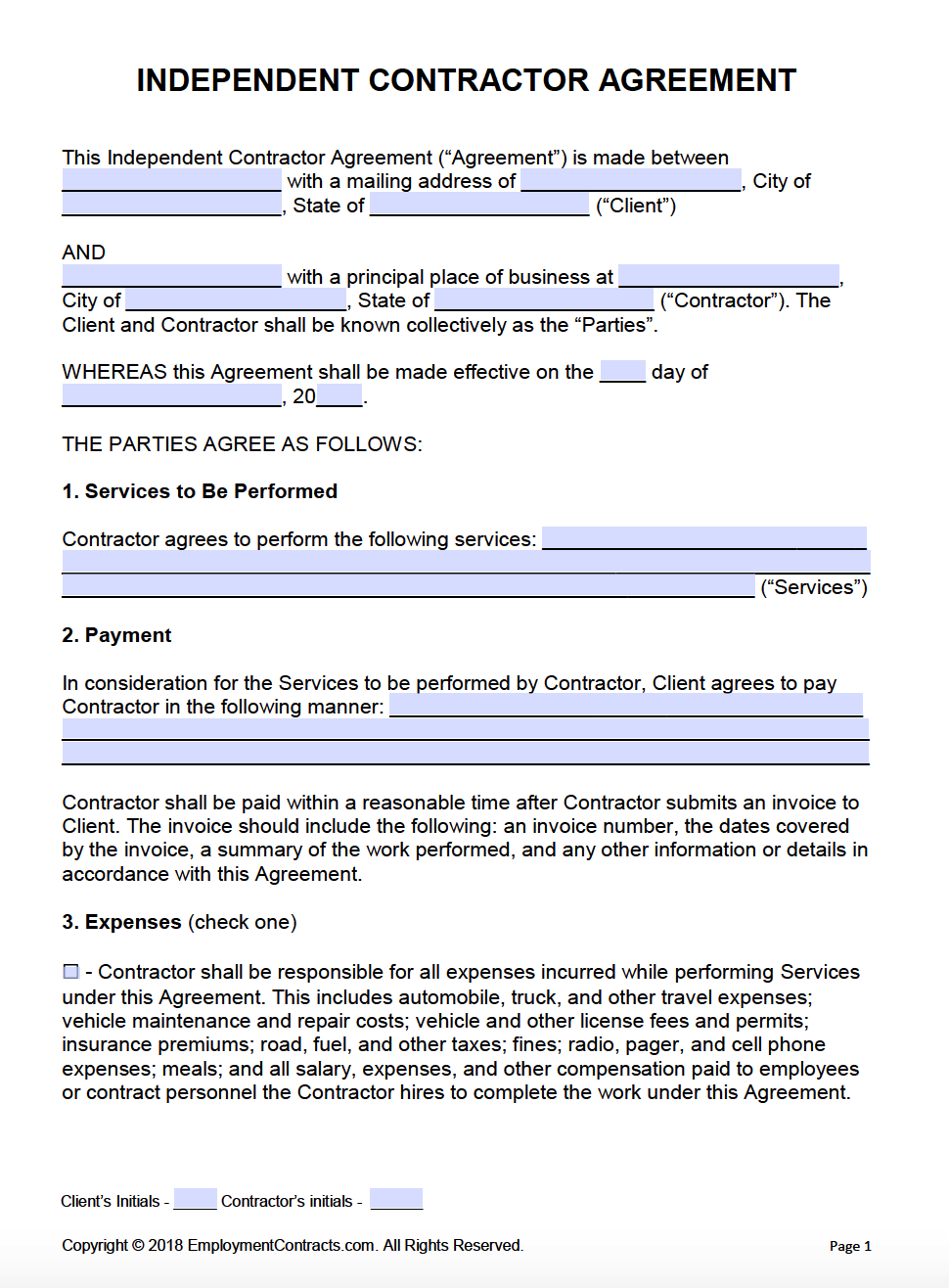

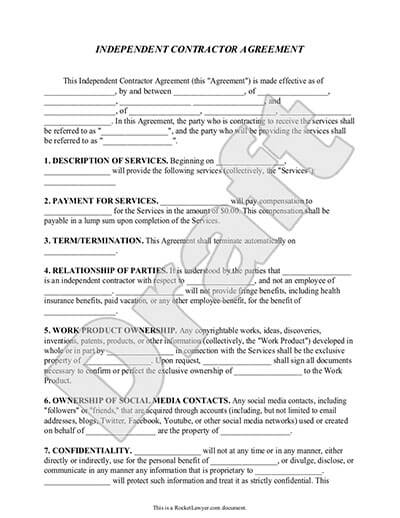

For example, if you give a worker a 1099 Form rather than a W2 Form, they may still be an employee Persons who work for you may qualify as employees under the law, even if, for example You have the person sign a statement claiming to be an independent contractor;1099 Tax Form Independent Contractor – A 1099 Form is basically a form that permits you to definitely track and report any income, costs, or business transactions which are due for reporting You need a tax form called a 1099 for many factors When you file a federal tax return, your employer will most likely send you a form in the beginning of every year that tracks your The most important document you will need to hire freelancers and independent contractors is an Independent Contractor Agreement This outlines the terms of a deal between a client and contractor and makes the agreed terms legally binding It will also be necessary to have an IRS form W9 available when you begin the process of hiring a contractor

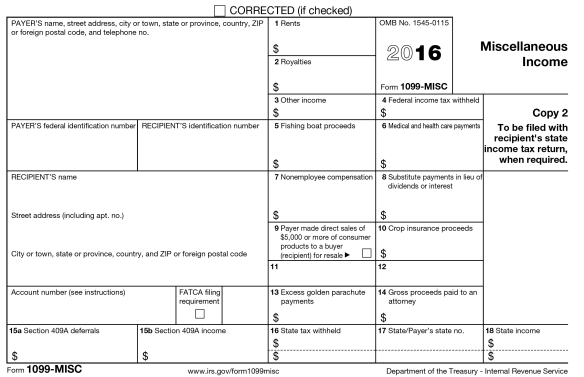

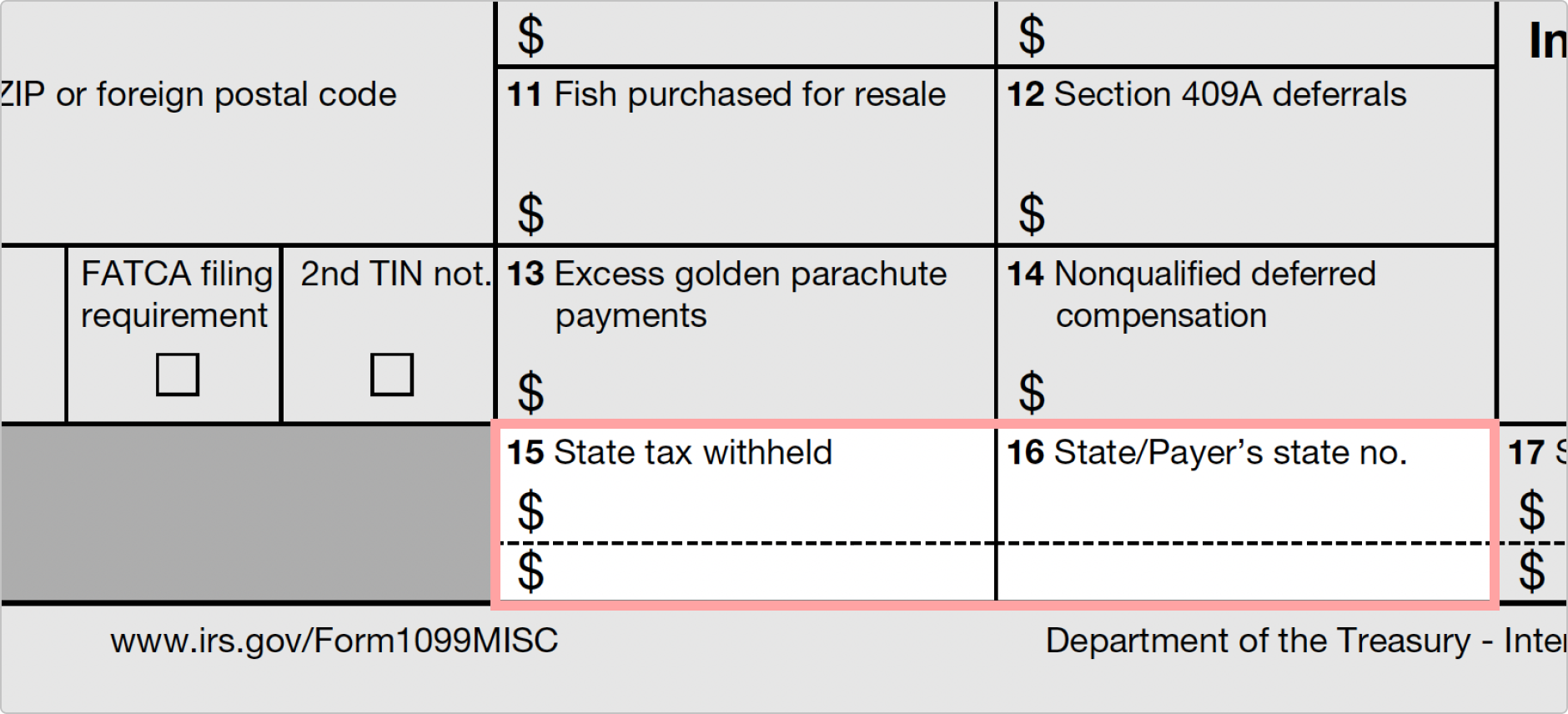

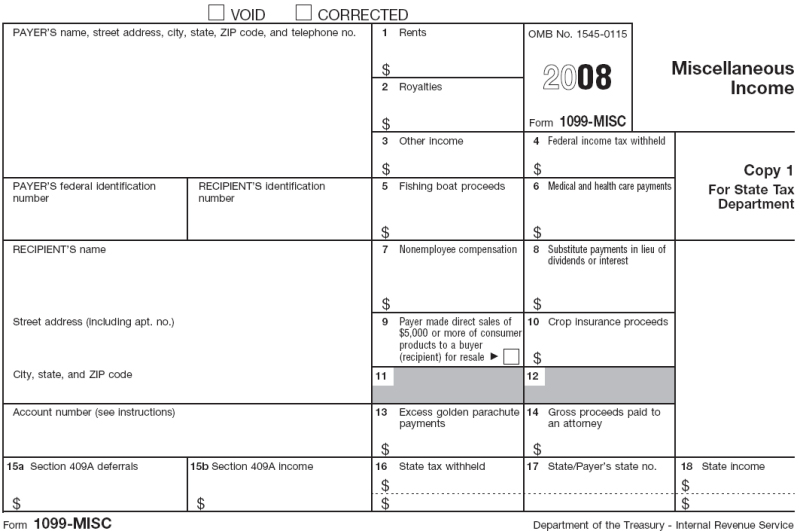

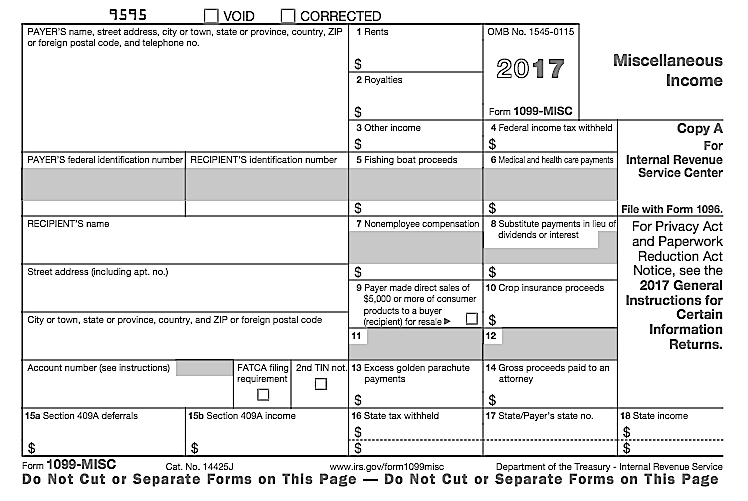

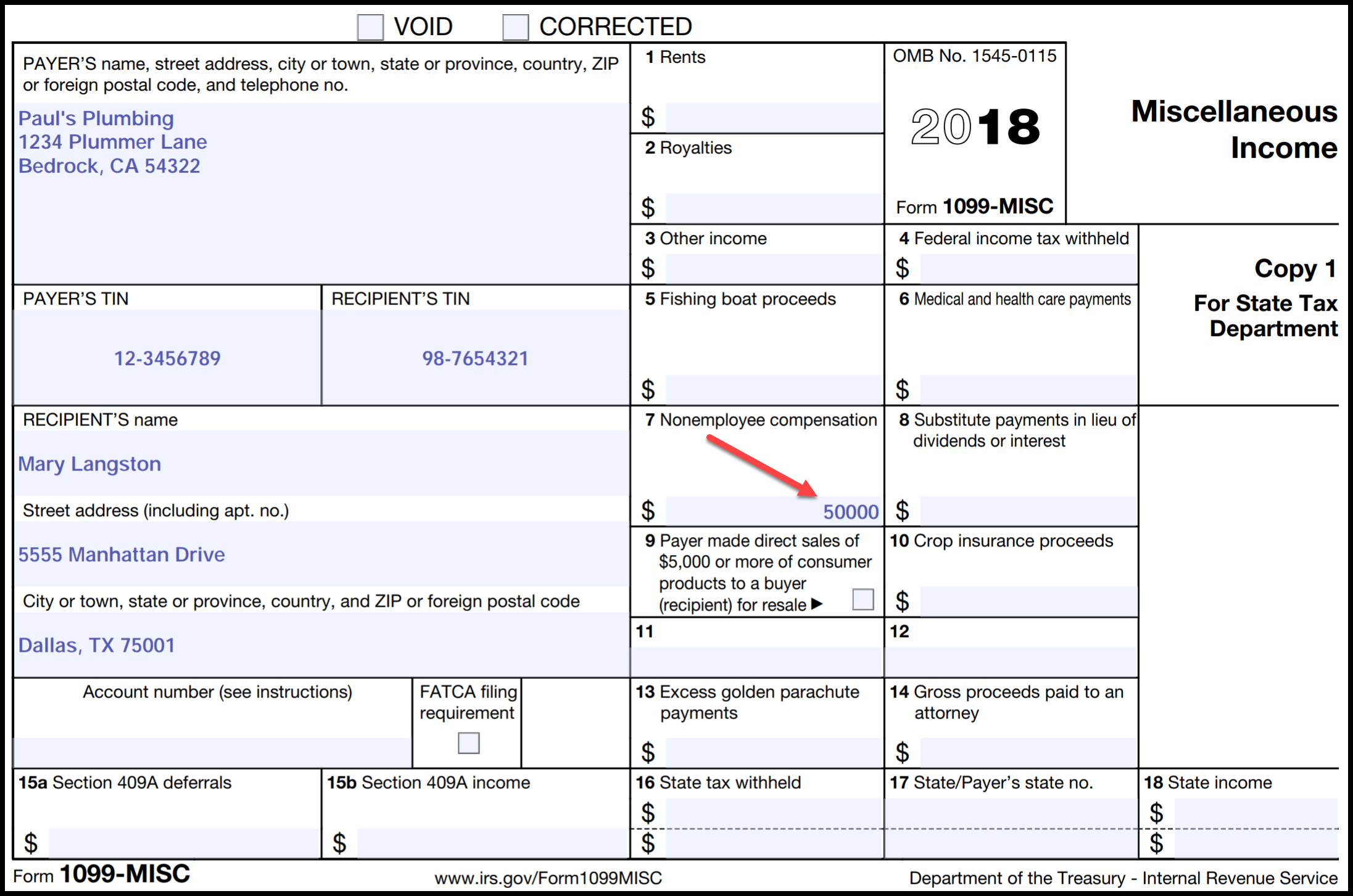

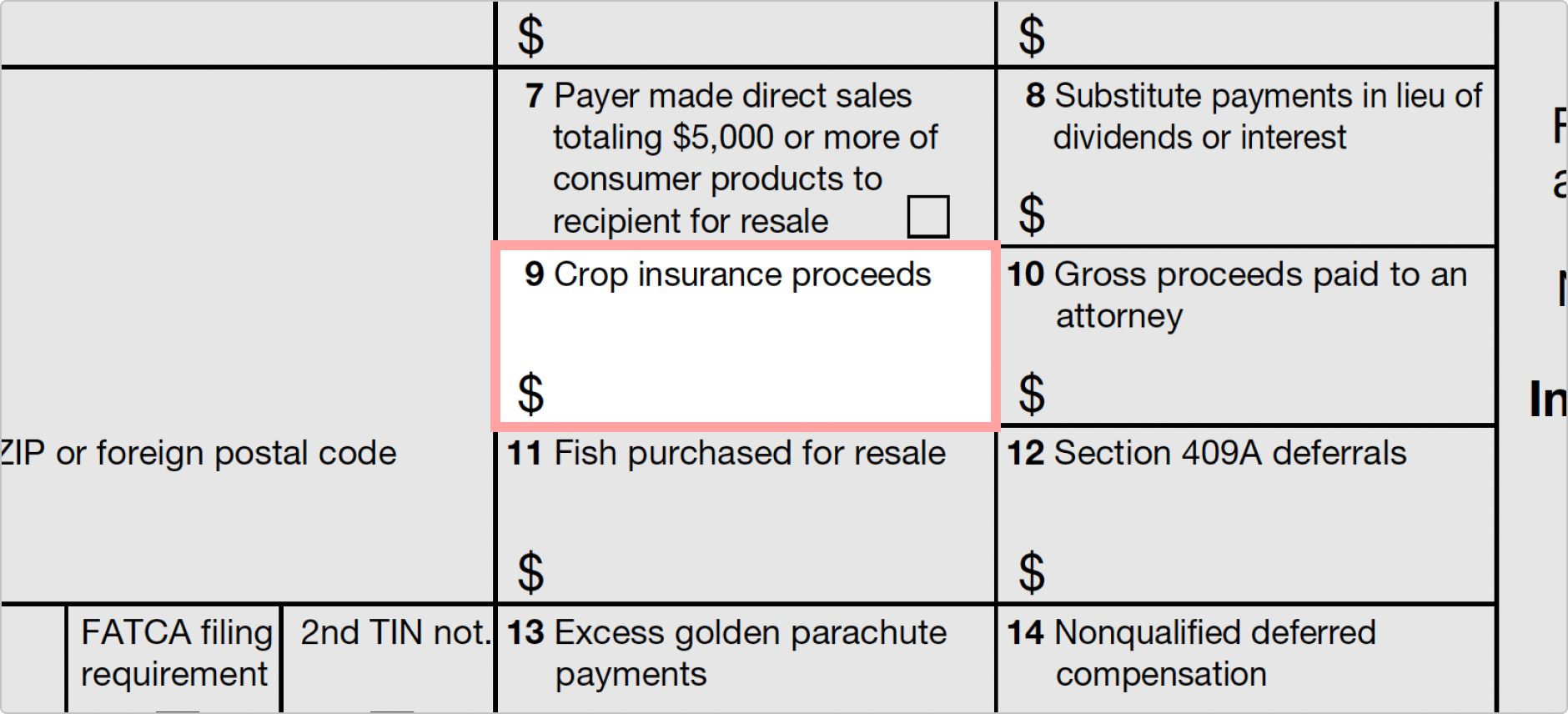

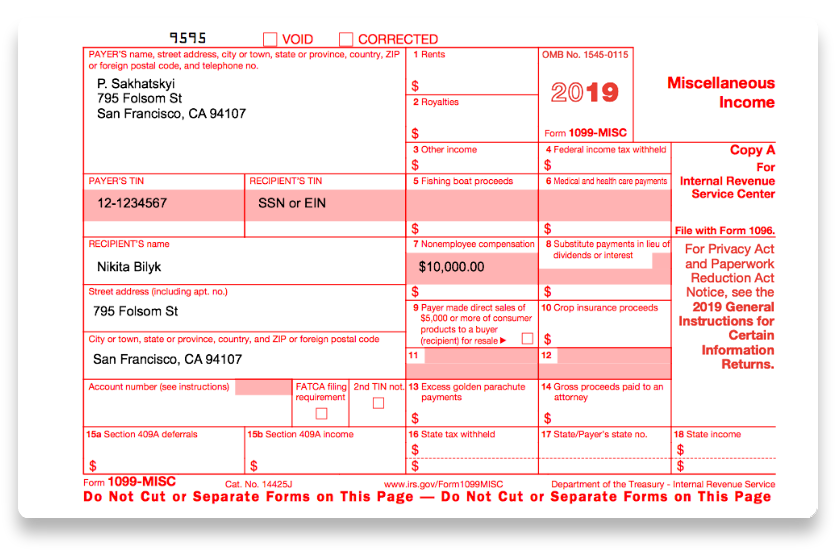

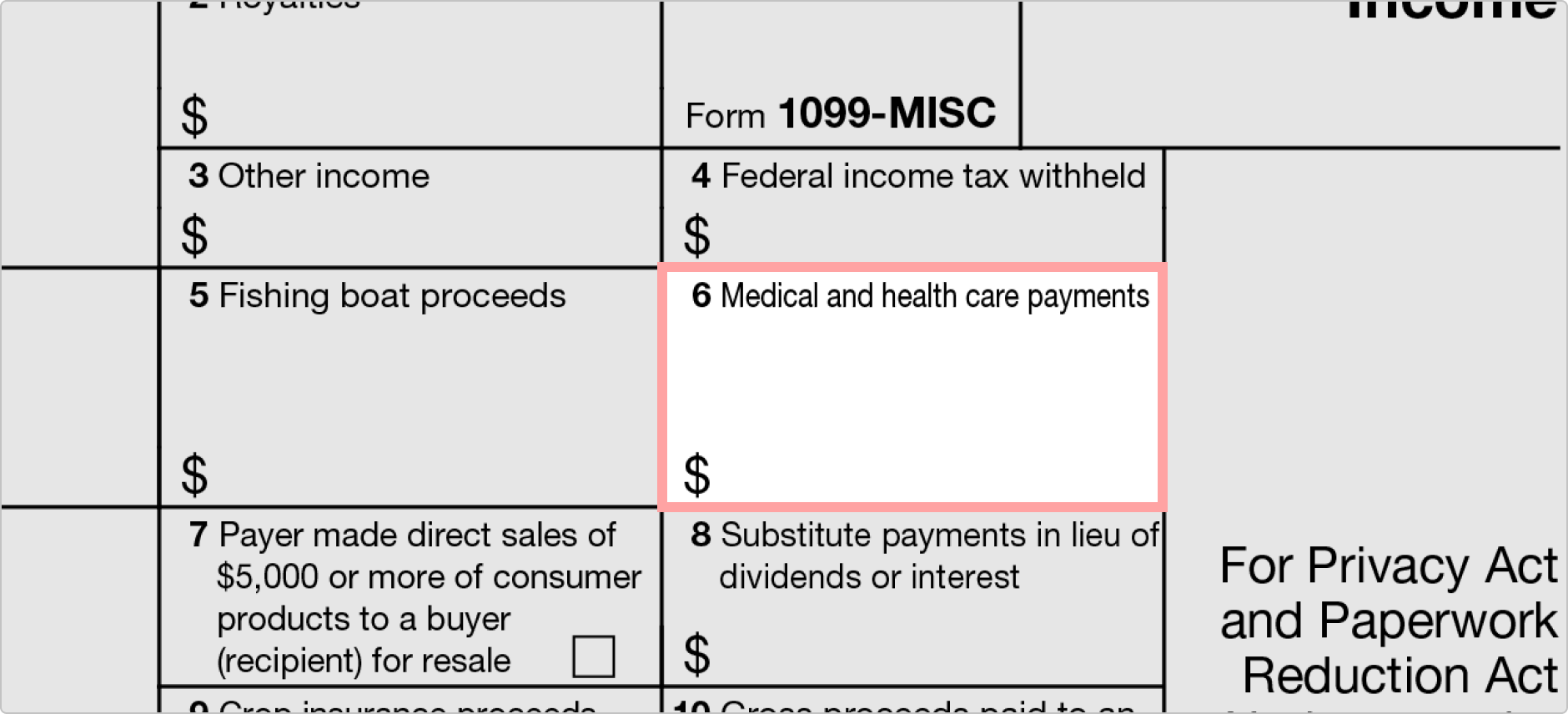

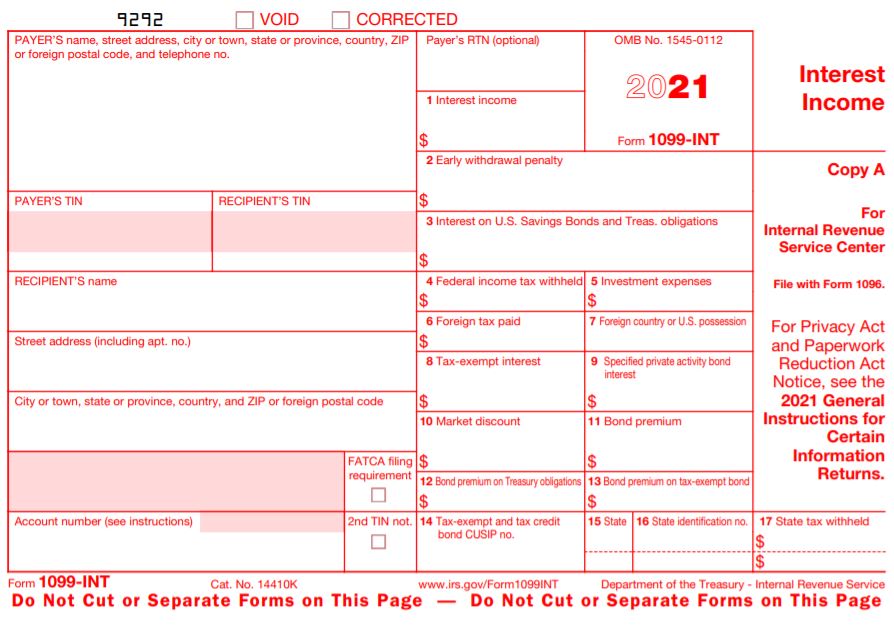

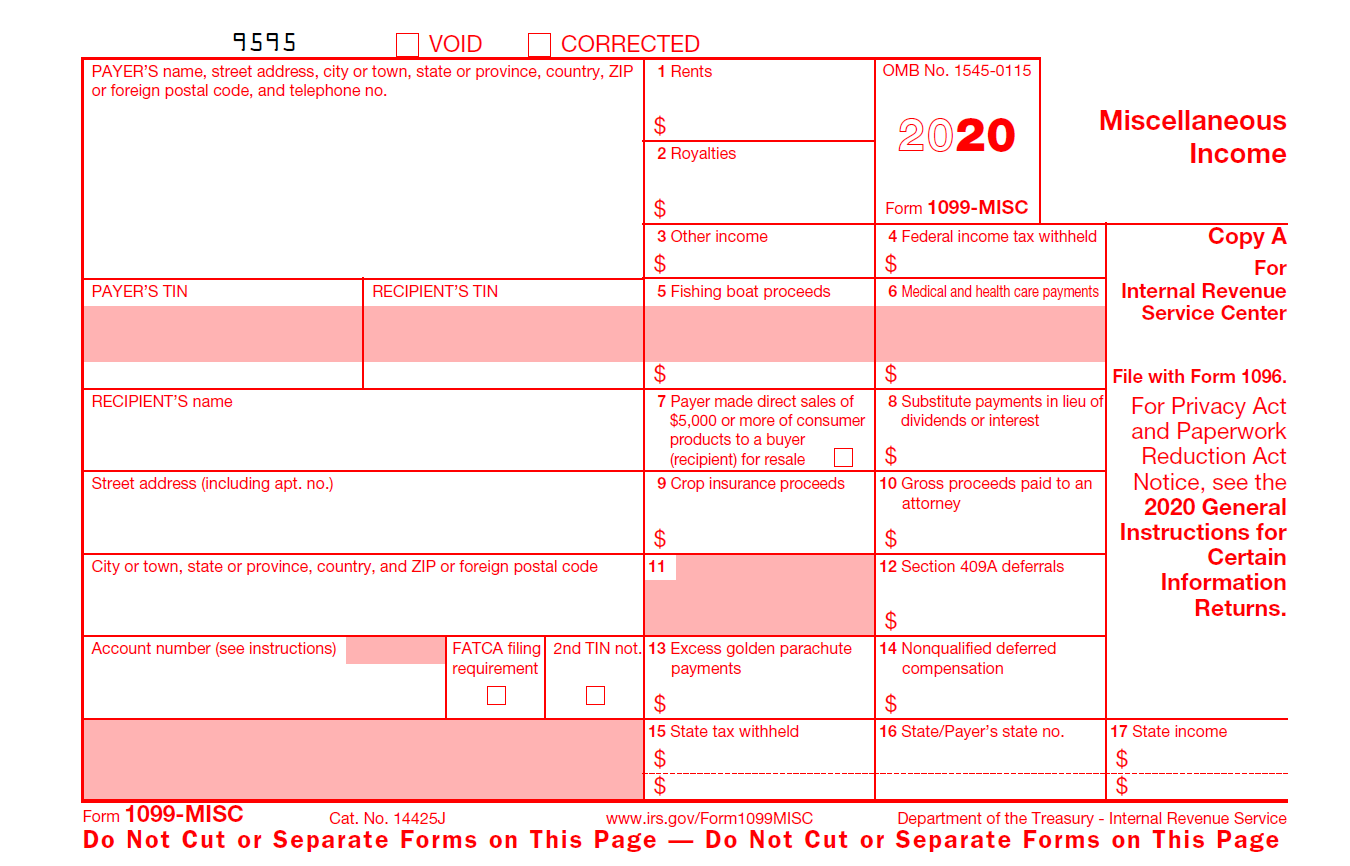

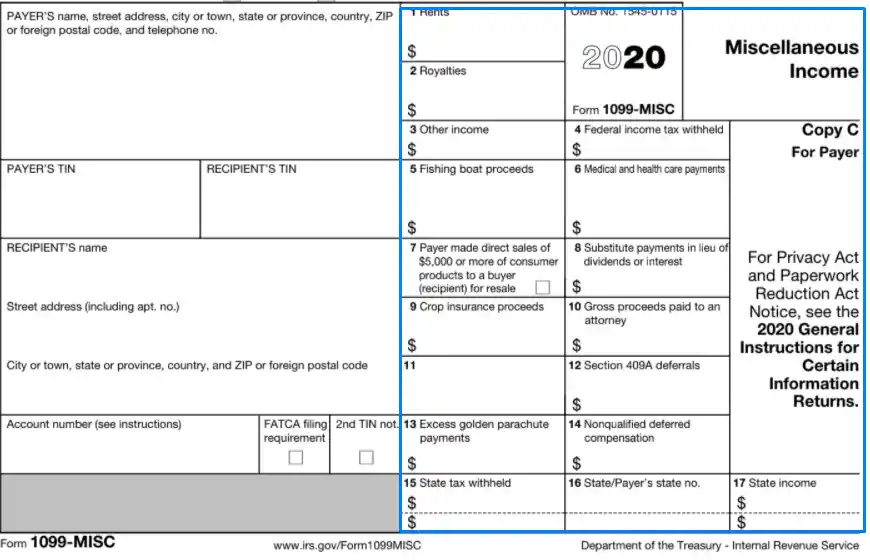

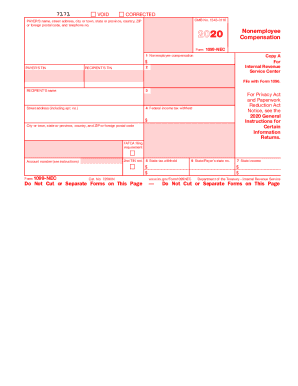

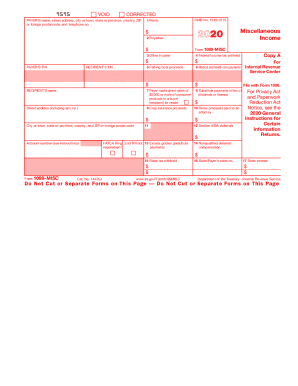

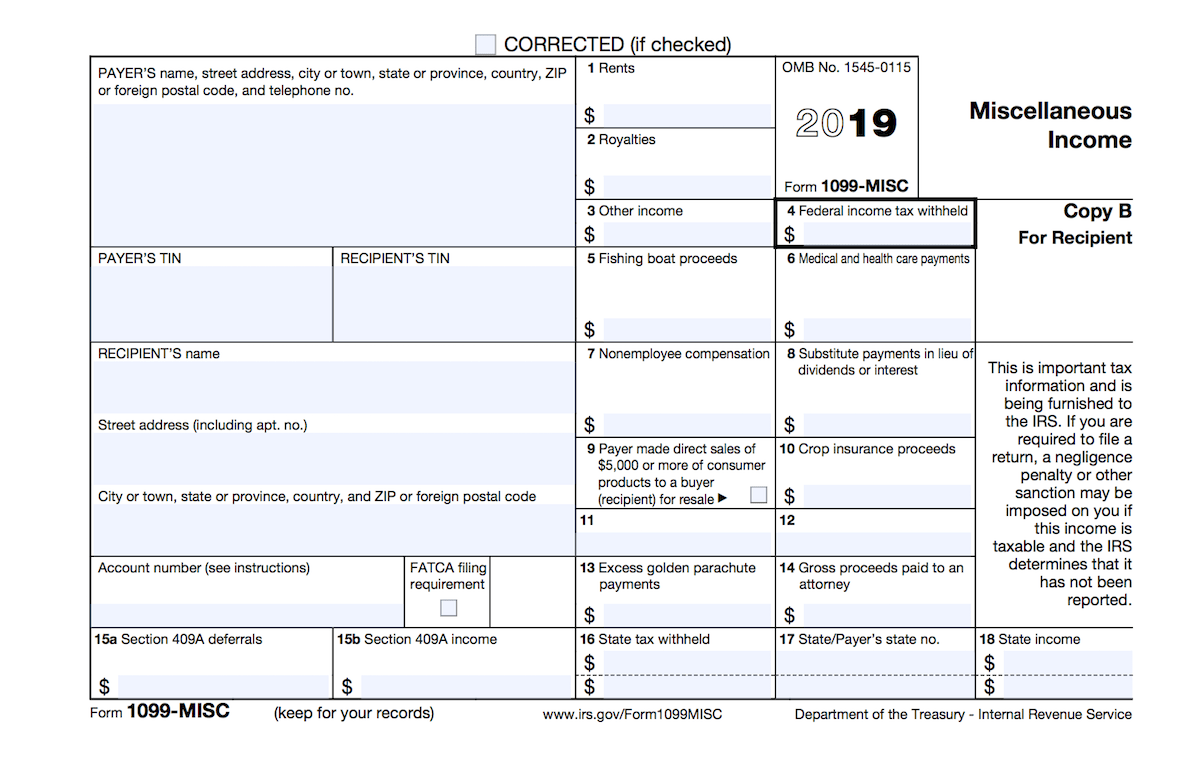

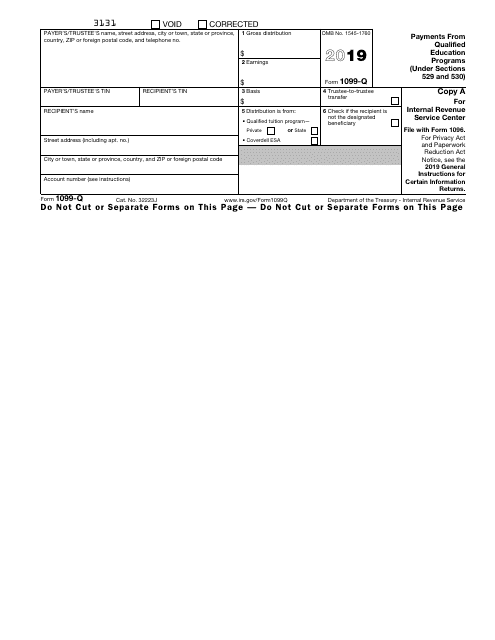

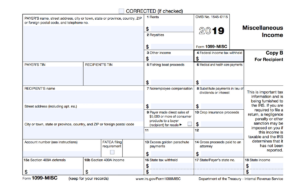

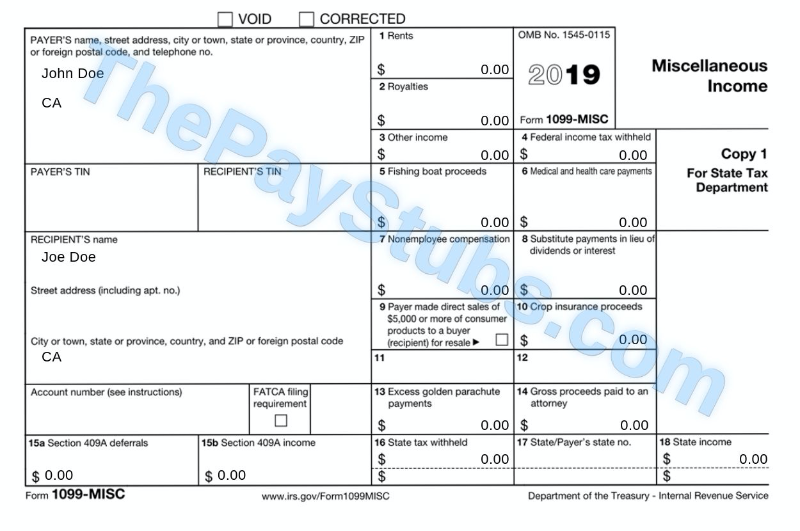

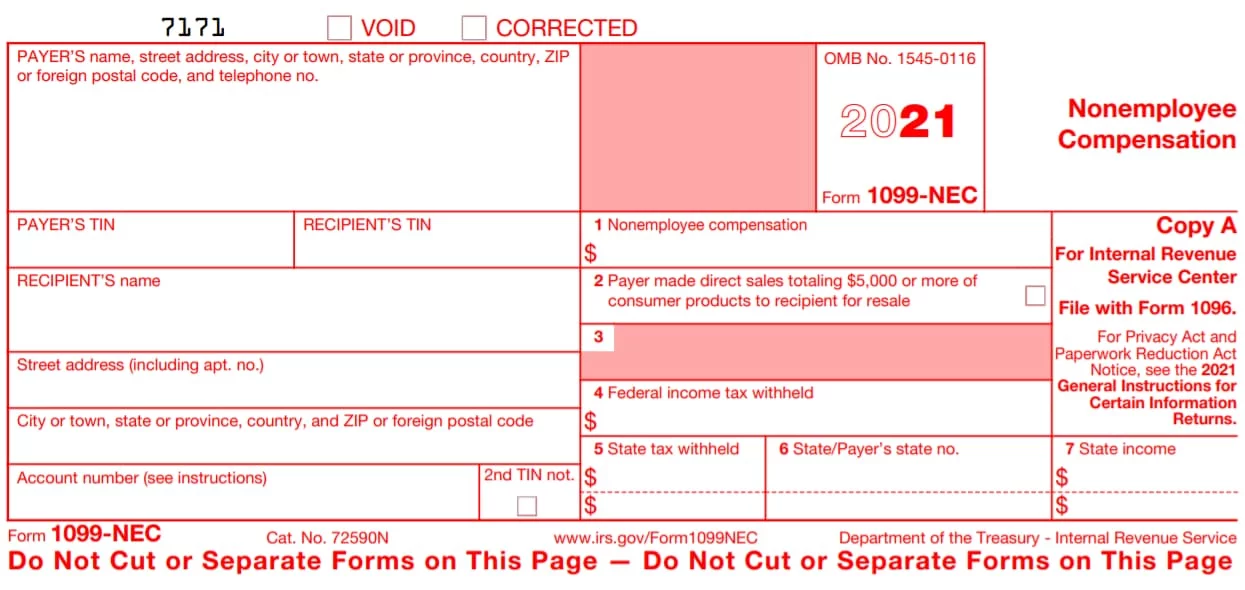

Among the numerous tax forms, the IRS will be expecting you to fill out a 1099MISC form in two casesyou made payments to freelancers or independent contractors for businessrelated services totaling at least $600 within the year;or you paid minimum $10 in royalties or broker payments in lieu of dividends or taxexempt interestHowever, if you Form 1099A is a form issued by a bank or other financial institution to a person who has made a deposit or withdrawal from the institution The form must be filed with the Internal Revenue Service (IRS) by the institution The form reports the total amount the taxpayer deposited or withdrew and the date of the transaction Form 1099A is also known as a reconciliationBlank 1099 Form Printable – The 1099 forms report certain types of income that a tax payer earns during the year It's important because it's used to track the nonemployment income of tax payers A 1099 is issued for cash dividends that are received to buy stock, or to record interest earnings from the bank account

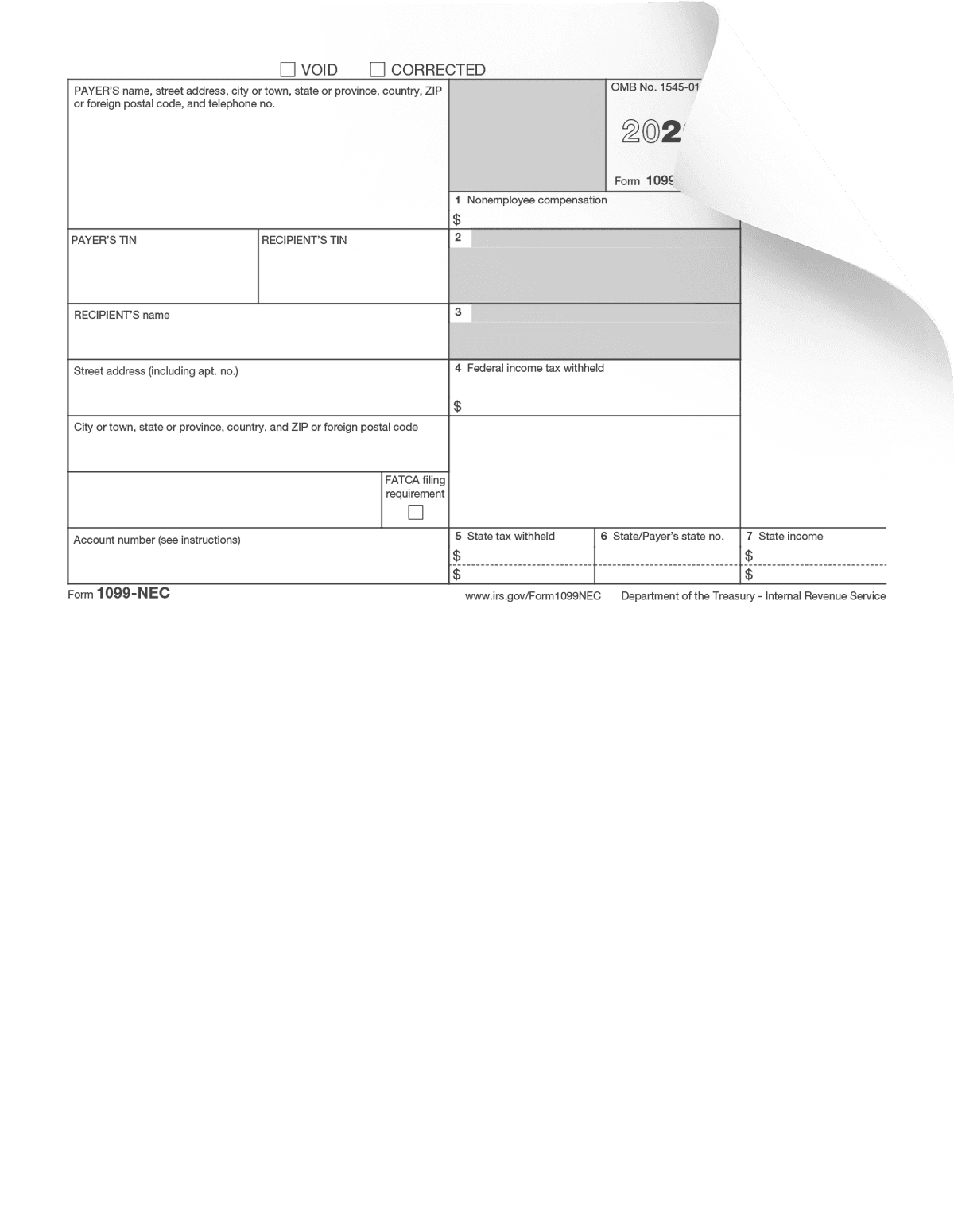

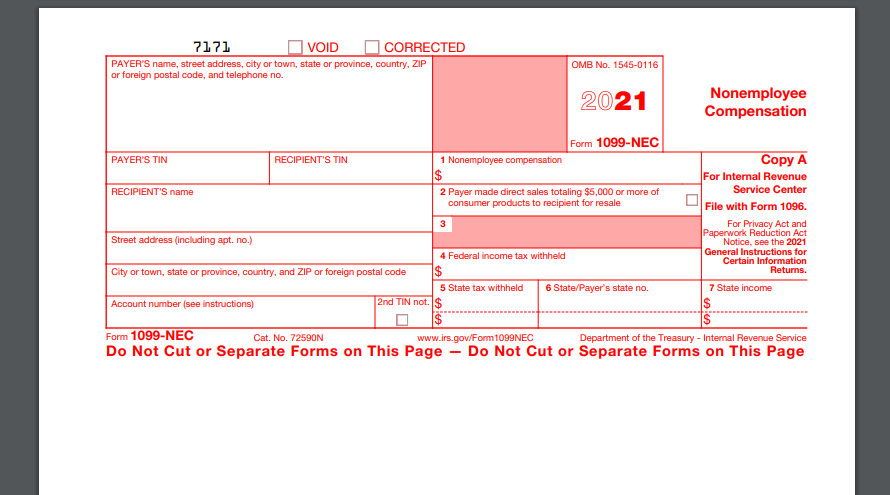

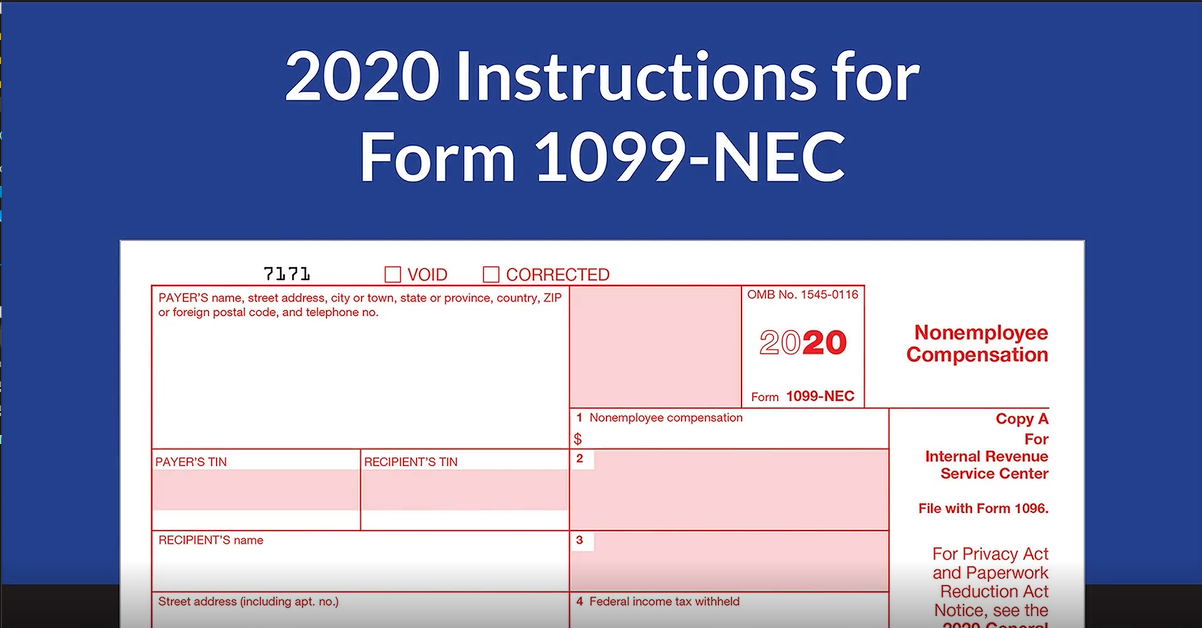

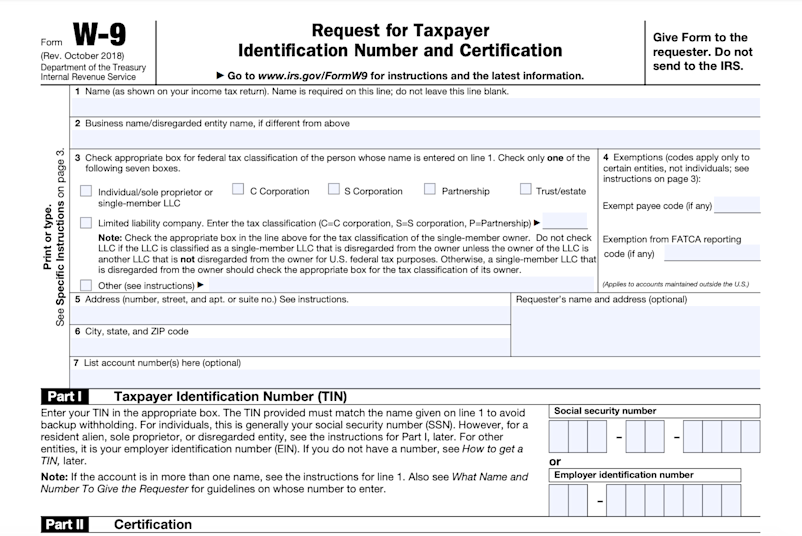

21 Gallery of Printable 1099 Forms For Independent Contractors Irs 1099 Forms For Independent Contractors Free 1099 Forms For Independent ContractorsForm 1099MISC is out and 1099NEC is in Stay in the IRS' good graces, and avoid fines, by completing the new 1099NEC form on time and correctly DOL proposes new rule to define independent An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreements

Form 1099 Misc Bhcb Pc

1099 Misc Form Fillable Printable Download Free Instructions

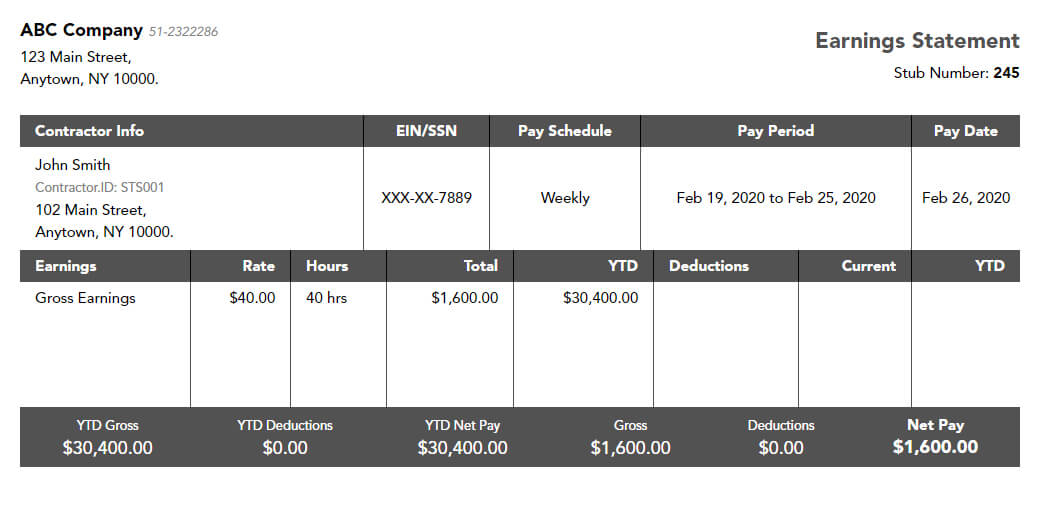

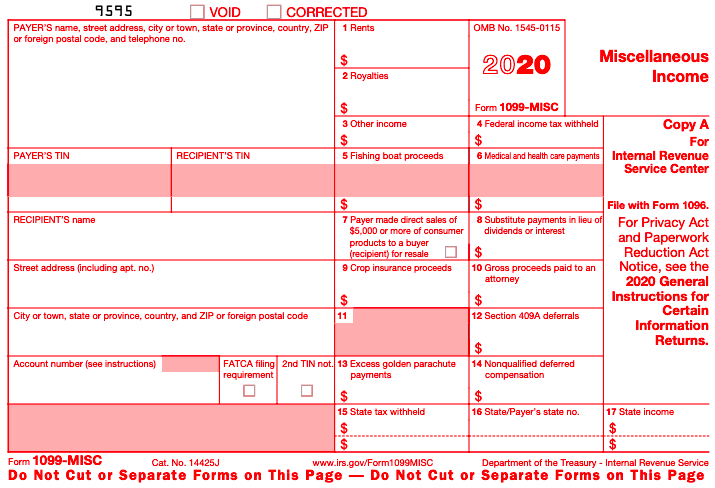

Independent contractors handle taxes related to social security, medicare etc Employers have to produce a W9 to be completed by the independent contractor You may have to file information returns (form 1099MISC) to report certain types of payments made to independent contractorsStarting with the tax year of , a 1099MISC Form is meant to be filed for every person (ie nonemployee) you have paid over $600 for an assorted list of miscellaneous business payments The list of payments that require a business to file a 1099MISC form is featured below A 1099NEC Form is now the appropriate form to file for compensation over $600 to nonemployees, freelancers and contractorsIndependent Contractors and the 1099 If an employer has paid an independent contractor more than $600 in payments related to the business, then the employer will need to fill out an IRS Form 1099MISC This form will provide an income summary of all the employer's compensation that is not employee related This form will be what the IC uses

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Free Independent Contractor Agreement Pdf Word

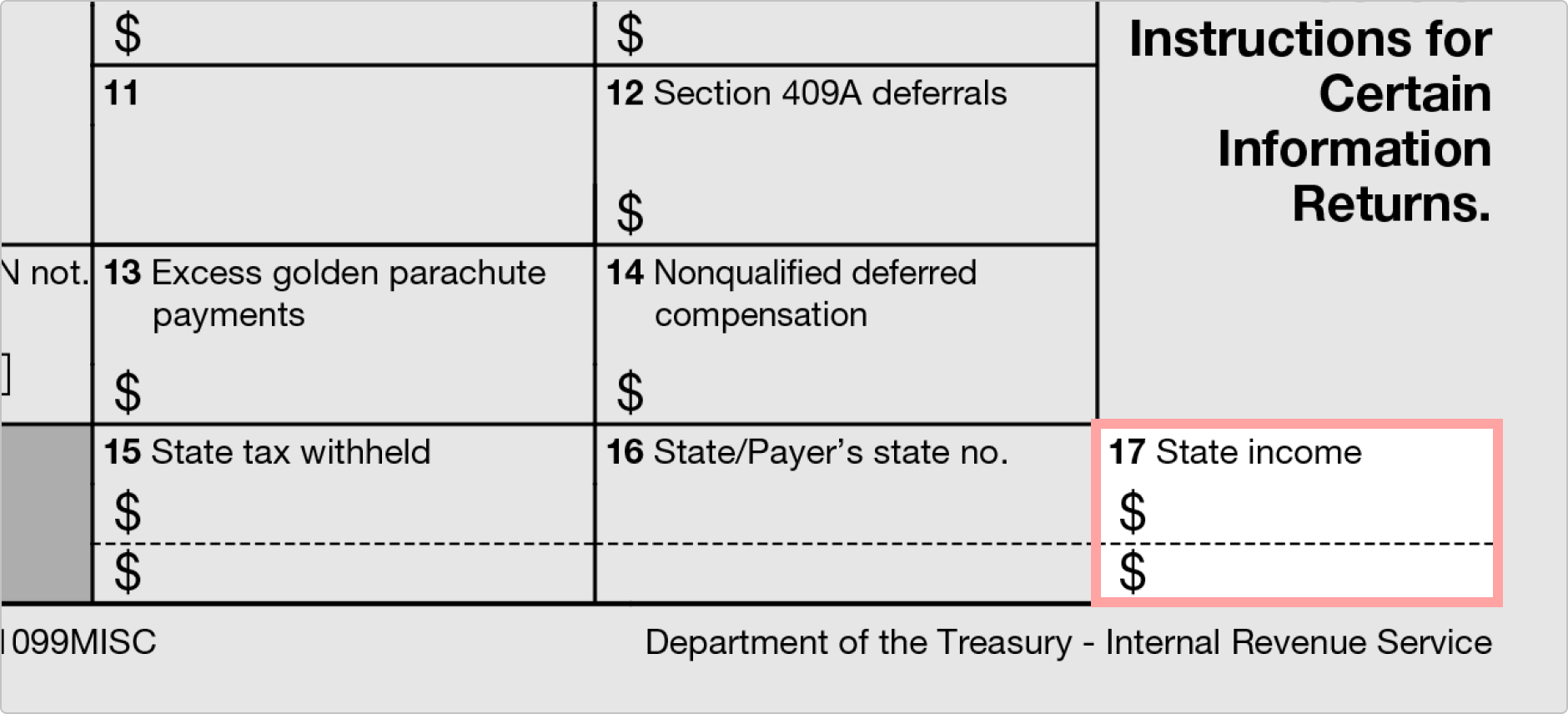

Tax form 1099 is generally used to report payments to nonemployees, such as independent contractors and freelancers It may also be used to show other kinds of payments, such as rental income or standby charges for a VOD payment Printable form 1099 blank should not be used to report wages paid to employees Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC) Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)

How To Fill Out And Sign Your W 9 Form Online To Get Paid Faster

Form 1099 Nec Instructions And Tax Reporting Guide

Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year if1099 MISC form should be filled accurately so the IRS can appropriately tax contractor's income 1099 Form Independent Contractor Agreement It is required to dispatch a copy of IRS 1099 Form Independent Contractor Agreement to the respective personnel by January 31 of the year following the payment Also, it is to be noted that the A To file the Form 1099MISC, you'll need a Form W9 and a Tax Identification Number (TIN) for each independent contractor The contractor provides you the Form W9 You should have every contractor fill out this document before services are provided This will ensure you have the information you need to file

1

Schooltheatre Org

Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agreesThere are various types of 1099 forms as there are many methods to earn income from nonemployment For example freelancers and independent contractors earning $600 or more in nonemployment earnings should be qualified for a 1099 as of 1 Who should be the beneficiary of the 1099 form?IRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work

Form W 9 Blank Fillable Printable Download For Free W 9 Instructions

Form 1099 Nec Form Pros

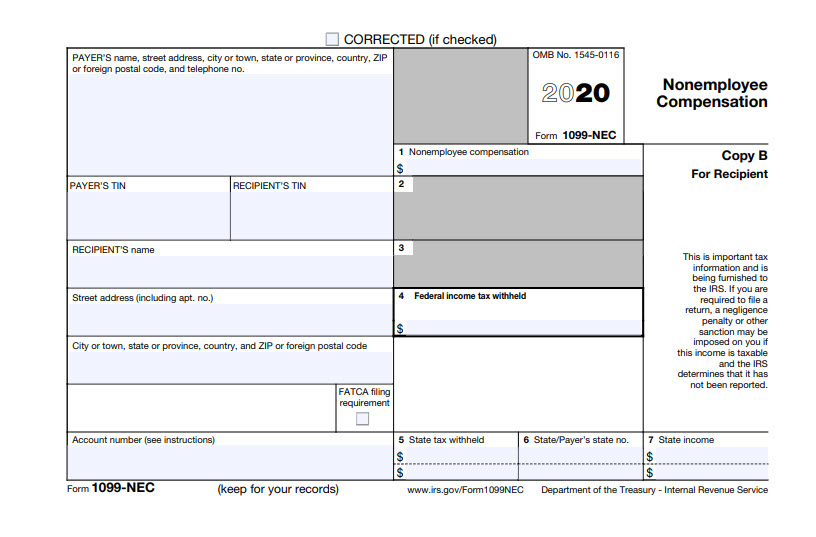

Click on the Get Form option to start filling out Switch on the Wizard mode on the top toolbar to have more tips Fill in each fillable field Ensure that the details you add to the 1099 Termination Letter is uptodate and accurate Include the date to the form using the Date function Click on the Sign button and make a signatureIRS Form 1099NEC is not a replacement for Printable 1099Misc Form This New NEC forms replacing the use of 1099Misc Form for reporting independent contractor payments 1099NEC Form is not a new form and it was last used in 19 Now, the IRS is reviving the form in the tax yearPayer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement You also may have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax If your net income from selfemployment is $400 or more, you must file a return and

1099 08

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Form 1099MISC is oftentimes mandatory and commonly used by businesses to report other income payments to freelancers and independent contractors If you're not going to use Form 1099MISC other than this purpose, consider filing Form 1099NEC as it's simpler, and you won't need to file multiple Forms 1096A 1099 form is used to report nonemployment income that includes dividends by owning stock or income that you earned as an independent contractor There are several 1099 forms as there are various kinds of incomesuch as interest income, tax refunds for local taxes as well as retirement account payoutsThe 1099 print dialog allows you to select one 1099 recipient, all 1099 recipient (s) or a range of 1099 recipients The dialog also allows you to find a specific 1099 recipient to

17 1099 Form New York Truckstop

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

Does an employer require a W9 Form to file 1099? The new Form 1099NEC has replaced 1099MISC to report nonemployee compensation Your contractors are valuable workers, and you need to submit accurate tax information on their behalf The first step is to determine whether each worker is an independent contractor or an employee 1099NEC is the version of Form 1099 you use to tell the Internal Revenue Service whenever you've paid an independent contractor (or other selfemployed person) $600 or more in compensation (That's $600 or more over the course of the entire year)

1099 Form Fill Out And Sign Printable Pdf Template Signnow

1099 Form 19 Pdf Fillable

1099 Form Independent Contractor Pdf / Printable IRS Form 1099MISC for 15 (For Taxes To Be These can include deducting costs for your home office, vehicle expenses, advertising, continuing education, insurance prThe taxpayers are supposed to send 1099 MISC Forms to the contractors by February 1st, 21 Submit your Form 1099 online to the IRS by March 31st, 21 There are late penalties for payer's who file the information returns late As an independent contractor, you should file1099 form independent contractor Complete forms electronically working with PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve documents using a legal electronic signature and share them by using email, fax or print them out download forms on your computer or mobile device

1099 Form Irs 18

1099 Misc Form Fillable Printable Download Free Instructions

For certain types of income that aren't related to employment, the Form 1099IRS Form 1099 – To be filed with the IRS at the end of the year if the payer paid an independent contractor $600 or more Must be filed by January 31st following the calendar year Must be filed by January 31st following the calendar yearBlank Printable W9 – Form W9Request for Taxpayer Identification Number and Certification — is a commonly used IRS form If you have your own business or operate as an independent contractor a client may request that you fill out and mail a W9 so they can precisely prepare the 1099NEC form and report the payments

Online Irs Form 1099 Int 17 18 Irs Forms Irs Form

Independent Contractor Paystub 1099 Pay Stub For Contractors

IRS 1099 Form 21 Printable Print this templates There are various types of 1099 forms since there are various methods to earn income from nonemployment For example, freelancers and independent contractors earning more than $600 in nonemployment income must be qualified for a 1099NEC by the year from 1_____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor agree as follows 1 Work However, reporting these types of earnings to the IRS is a must Thus, the 1099 MISC form is an important IRS tax document where you are required to register and report your nonemployment payments/outside income If you're a business owner, you must send the 1099 Form to all the independent contractors that

1099 Misc Form Fillable Printable Download Free Instructions

Get Your 1099 Miscs Right In 5 Easy Steps Cartwheel Technology Solutions For Business

5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply)

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

1099 Form Independent Contractor Pdf Irs Form W 9 Fill Out Printable Pdf Forms Online

21 Blank W9 Form W9 Tax Form 21

Where To Report Payment Made To Independent Contractors On Form 11 S Nina S Soap

What Is An Irs 1099 Form Paperwingrvice Web Fc2 Com

1

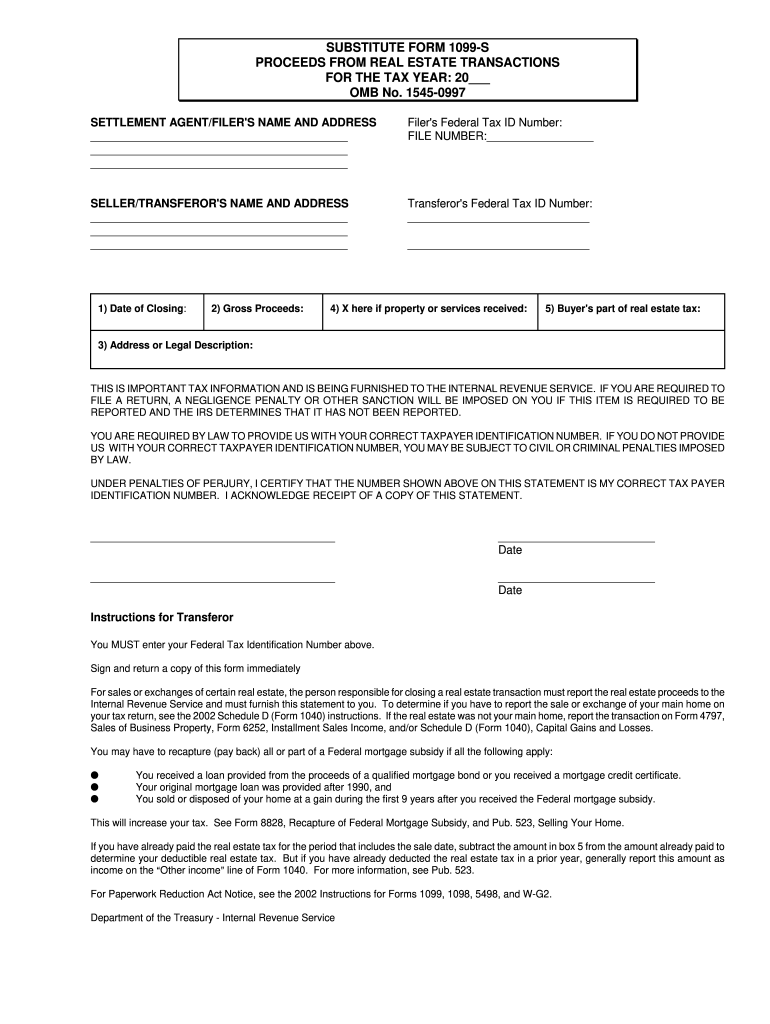

Irs 1099 S Substitute Form Fill And Sign Printable Template Online Us Legal Forms

1099 Misc Form Fillable Printable Download Free Instructions

1099 Nec Available

Klauuuudia 1099 Misc Template

W9 Form 21 Printable Payroll Calendar

Do I Need To File 1099s Deb Evans Tax Company

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Form 1099 Nec For Nonemployee Compensation H R Block

Create An Independent Contractor Agreement Download Print Pdf Word

1099 Form Printable Get Irs Form 1099 Printable For In Pdf Fillable Blank Template 1099 Misc

1099 Form 18 Fill Out And Sign Printable Pdf Template Signnow

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

1099 Software 1099 Printing Software 1099 Efile Software And 1099 Forms Software

Who Are Independent Contractors And How Can I Get 1099s For Free

1

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

Independent Contractor 1099 Invoice Templates Pdf Word Excel

Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Misc 14

Payroll Forms Frequently Asked Questions And Links Office Of The Controller Wright State University

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Misc Form Fillable Printable Download Free Instructions

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

Form 1099 Nec Instructions And Tax Reporting Guide

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

1099 Form 19 For Independent Contractors

1099 Forms Printable 1099 Forms 21 22 Blank 1099

How To File 1099 Misc For Independent Contractor

Form 1099 Requirements

Fillable Form 1099 Misc 21 Printable Form 1099 Misc 21 Blank Sign Forms Online Pdfliner

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

What Is The Account Number On A 1099 Misc Form Workful

Time To Submit W 2 And 1099 Forms Whitneysmith Company

How To Generate Enable And Print Quickbooks 1099 Form Postechie By Jeremih Issuu

How To File 1099 Misc For Independent Contractor

Free 1099 Misc Template Word

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 K Wikipedia

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

What Is A 1099 Contractor With Pictures

1

Fill Out A 1099 Misc Form Thepaystubs

1099 Nec Form 21 Get Irs Form 1099 Nec Instructions 1099 Misc Vs 1099 Nec Difference Printable Sample

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

S Irs Forms Fill Out And Sign Printable Pdf Template Signnow

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Independent Contractor Agreement

Brilliant Download 1099 Forms For Independent Contractors Models Form Ideas

1099 Online No 1 1099 Generator Thepaystubs

How To File A 1099 Misc Online 21 Qasolved

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Get W 2 Forms And 1099 Misc Forms

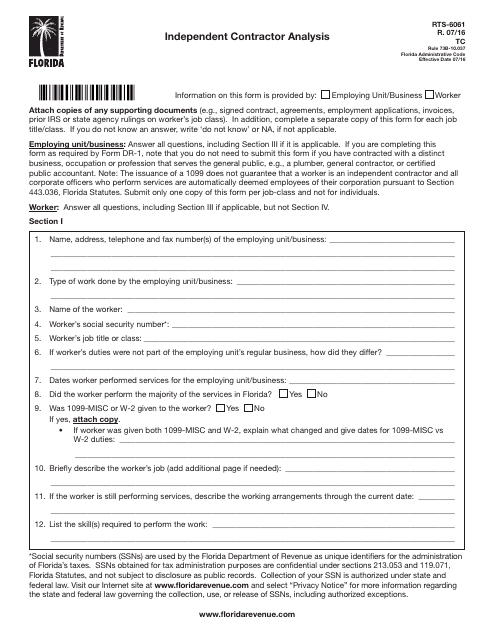

Form Rts 6061 Download Printable Pdf Or Fill Online Independent Contractor Analysis Florida Templateroller

Fill Free Fillable Irs Pdf Forms

1099 Form 19 Online Tax Form 1099 Irs All Extensions To Print With Instructions

Irs Form 1099 Reporting For Small Business Owners In

Irs W9 Form 21 Printable W9 Form 21 Printable

W 9 Form Fill Out The Irs W 9 Form Online For 19 Smallpdf

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It

1099 Nec Form 22 1099 Forms Taxuni

Free Independent Contractor Agreement Free To Print Save Download

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

1099 Excel Template

W 9 Form 21 Fillable Printable

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

0 件のコメント:

コメントを投稿